top of page

CLIENT DOWNLOADS

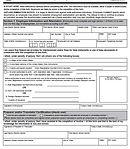

Essential Employment Forms

Published: February 2025

Published: February 2025

Flexible Spending Accounts & Commuter Benefits

FUSION Modification Documents

New York Employers

Additional Employee & Payroll Forms

Year End Forms

Extras

bottom of page